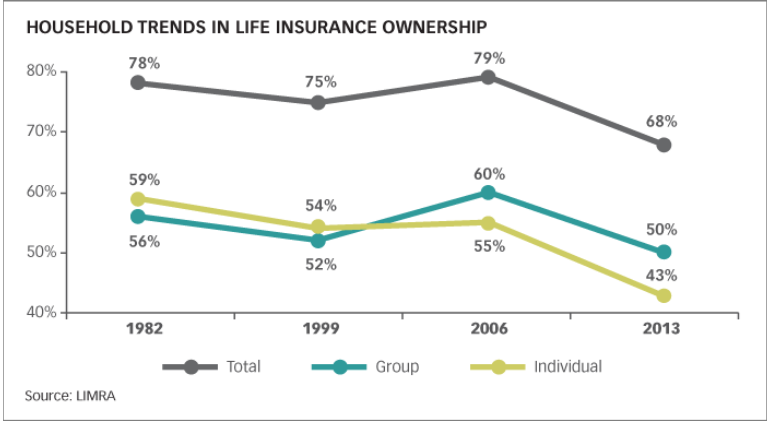

Only 68% of Canadian households have life insurance

REASONS WHY PEOPLE DON’T BUY LIFE INSURANCE

As it turns out, there are many reasons why young people don’t buy life insurance and, quite frankly, a lot of them are bad reasons that can be generally be solved with better communication about the value of the various products available to them today.

1. IT’S TOO EXPENSIVE

Median answer people give was 3X the actual cost! The idea would be to challenge them to an experiment. Set up a campaign that challenges your prospects to guess the cost of their insurance, follow up with a presentation that shows how affordable life insurance can be for different term lengths.

2. I DON’T UNDERSTAND IT!

The best time to buy is as soon as one can afford it, to take advantage of low premium rates and your good health. No one can by insurance if they are sick or unhealthy for an affordable price. Visualization cartoon pictures. Of husband going to work in the morning with wife and kids at home and returns home at night. Happens daily… now break the circle of life by having the husband crash into a tree and not return home because he died. What happens without insurance?

3. THINK THEY HAVE ENOUGH COVERAGE; I HAVE ENOUGH MONEY.

Life insurance comes in all sizes and shapes & has even more applications, the primary purpose is to fund a liability of loss at a lower cost. One objection is that think you may have enough money or assets that should they die life insurance would be pointless because their beneficiaries could liquidate them into cash should the need arise. Why should they liquidate everything that you have worked so hard to obtain? Life insurance can complement an asset strategy. Some of the biggest policies I have seen sold have been to solve trapped capital inside of corporations where wealth transfer would have resulted in excessive taxation. Too much money is a good problem as far as problems go but life insurance can reduce taxation and enhance the efficiency of asset transfer, something no one would object to. Paying less tax or no tax.

4. I DON’T WANT TO TAKE A MEDICAL

Popular objection amongst younger consumers who are increasingly convenience-oriented or perhaps those more skeptical of revealing their health information to insurers or the MIB. Most people don’t know that insurance companies are updating their underwriting requirements to accommodate societal changes, such as the legalization of Marijuana. Some of your existing rated clients might now be considered standard because of more favourable underwriting requirements.

5. PROCRASTINATING

The best time to buy was as soon as you can afford to buy. They want to buy we just need to motivate them. Make it easy if procrastinating and say they are busy, this is why we need a non-face to face application process where you can help them get insurance without hassle.

6. I HAVE OTHER FINANCIAL PRIORITIES

You can’t get blood from a stone. Meaning you may want insurance but they believe they can’t afford it. They are spending money in other areas, Cell phone or coffee, suggests that young people are directing a disproportionate amount of their income to areas of their life that give them satisfaction. They prioritize these items at the top of their list over there health, right or wrong. We need to protect the priority and change the thinking which comes with age.

7. I’M SUPER HEALTHY

Lots of people think that because they are super healthy they can buy life insurance at any time, this is the time to buy because it’s going to be the most affordable. The cost and the fact they can lock in their marathon physique health rating so when life catches up to them, they protected the health rating for best cost possible.

8. NOBODY HAS ASKED THEM

So, let’s ask them.

9. I DON’T HAVE LIABILITIES /DEPENDANTS

True! but when you do you will not have to worry about financial security.

10. MY EMPLOYER PROVIDES IT FOR ME

There are a few big issues that need to be addressed.

– is it enough insurance?

– will it be there at the time of death?

– does it provide anything for your spouse?

– will you be healthy enough when you retire to buy your own policy?

– what if you leave your job or worse are let go?